In the world of payments, surcharge fees have become a common practice for businesses. But what exactly is a surcharge, and how does it work? In this comprehensive blog post, we will delve into the details of surcharges, their purpose, when they occur, any limits associated with surcharge fees, and the legality surrounding their implementation. By the end, you’ll have a clear understanding of surcharges and their implications. Let’s get started.

What is a Surcharge?

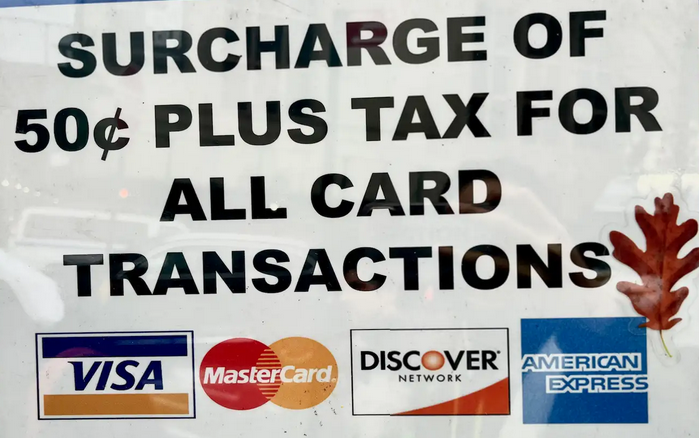

A surcharge is an additional fee imposed on customers for using a specific payment method, typically credit cards, to cover the costs associated with processing those transactions. It is an extra charge added to the total amount of a purchase as a percentage or a fixed amount.

What is the Purpose of Adding a Surcharge Fee?

The primary purpose of adding a surcharge fee is to offset the processing costs that businesses incur when customers use credit cards or certain payment methods. By passing on these costs to the customers, businesses aim to maintain profitability and avoid absorbing the expenses associated with accepting card payments.

When Does Surcharging Occur?

Surcharging occurs when businesses choose to impose an additional fee on customers for specific payment methods, such as credit cards or digital wallets. It is commonly seen in industries with thin profit margins or high transaction costs, such as retail, hospitality, and e-commerce.

Are There Any Limits to Surcharging Fees?

The limits on surcharge fees vary by country, state, or payment card network regulations. In some regions, surcharging may be prohibited or subject to specific restrictions. It is essential for businesses to familiarize themselves with local laws and regulations regarding surcharge fees to ensure compliance.

Is Surcharging Legal?

The legality of surcharging depends on the jurisdiction and specific regulations governing payment practices. In some countries, surcharging is allowed, while in others, it is prohibited or strictly regulated. Businesses should consult local laws and payment card network guidelines to determine the legality of surcharging in their region.

Surcharges are additional fees added to the total purchase amount to offset the costs of processing certain payment methods, typically credit cards. They provide businesses with a means to manage transaction expenses and maintain profitability. However, it is important for businesses to understand and adhere to local regulations regarding surcharges. By doing so, businesses can navigate the world of surcharge fees effectively and transparently while ensuring compliance and customer satisfaction.

FAQs about Surcharges

What is the Purpose of a Surcharge?

The purpose of a surcharge is to recover the costs associated with processing certain payment methods, primarily credit cards, by passing on the fees to customers.

What is an Example of a Surcharge?

For example, a retailer may add a 3% surcharge fee to the total purchase amount when a customer pays with a credit card, compensating for the fees imposed by the card networks and payment processors.