As a business owner, you may have come across the term “Merchant ID” in your payment processing journey. But what exactly is a Merchant ID number, and why is it essential for your business? In this comprehensive guide, we will delve into the meaning of a Merchant ID, its purpose, why your business needs one, how to find or obtain it, whether businesses can have multiple Merchant IDs, and address common questions surrounding this crucial identifier.

Merchant ID Explained

A Merchant ID (MID) is a unique identification number assigned to businesses by payment processors or acquiring banks. It serves as a distinctive identifier for each merchant and is used to track and manage their payment transactions.

What Are Merchant ID Numbers Used For?

Record-Keeping: Merchant IDs help payment processors and acquiring banks maintain accurate records of transactions, making it easier to reconcile accounts and resolve any discrepancies.

Chargebacks: In the event of a chargeback, the Merchant ID is referenced to investigate and resolve the dispute efficiently.

Why Your Business Needs a Merchant ID

Having a Merchant ID is essential for the smooth and secure processing of payment transactions for your business. Without a unique identifier, payment processors would struggle to allocate payments correctly, leading to potential payment delays and customer disputes.

How to Find Your Merchant ID Number

To find your Merchant ID, follow these steps:

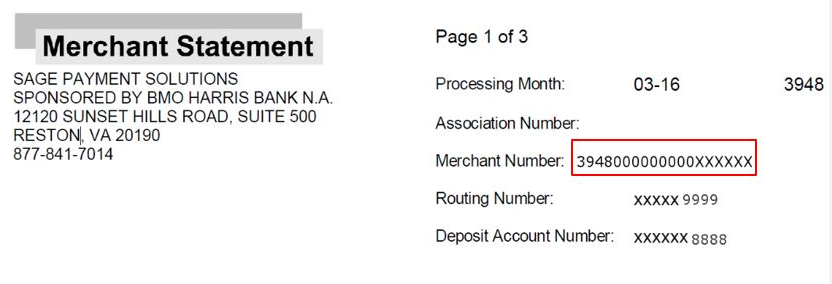

- Check Your Account Statements: Your Merchant ID is often displayed on your payment processing account statements.

- Contact Your Payment Processor: Reach out to your payment processor or acquiring bank, and they will provide you with your Merchant ID.

How to Get a Merchant ID Number

If you are new to payment processing or are switching payment processors, here’s how to obtain a Merchant ID:

- Choose a Payment Processor: Select a reputable payment processor that meets your business’s specific needs.

- Application Process: Complete the application process, providing all required business information.

- Approval and Merchant ID Assignment: Once approved, the payment processor will assign you a unique Merchant ID for your business.

Can Businesses Have Multiple Merchant ID Numbers?

Yes, businesses can have multiple Merchant IDs. This is especially common for large enterprises with multiple business units or different types of products and services. Each division or product line may have its own unique Merchant ID for better tracking and reporting.

FAQs about Merchant ID

Let’s address some common questions about Merchant IDs:

Q1: Is a Merchant ID the same as an account number?

No, a Merchant ID is different from an account number. The Merchant ID identifies the merchant, while the account number is associated with the specific bank account where funds are deposited.

Q2: What does an invalid Merchant ID mean?

An invalid Merchant ID typically indicates an error in the entered ID, or it could mean that the merchant’s account has been deactivated or closed.

Q3: How many digits is a Merchant ID number?

Merchant ID numbers can vary in length, but they are typically composed of 6 to 15 digits.

Q4: Can my Merchant ID be revoked?

Yes, in certain circumstances, a payment processor or acquiring bank may revoke a Merchant ID. This may happen if the business violates the terms of the merchant agreement, engages in fraudulent activities, or has an excessive number of chargebacks.