If you’ve ever wondered about the meaning of ACH transfers and how they work, you’re in the right place. An ACH bank transfer is an electronic payment method that allows funds to be transferred between bank accounts within the United States.

ACH Transfer Meaning

An ACH transfer, also known as an Automated Clearing House transfer, is an electronic payment system that facilitates funds transfer between banks. It operates under the rules of the National Automated Clearing House Association (NACHA) and is widely used for various types of transactions, including direct deposits and direct payments.

How ACH Transfers Work

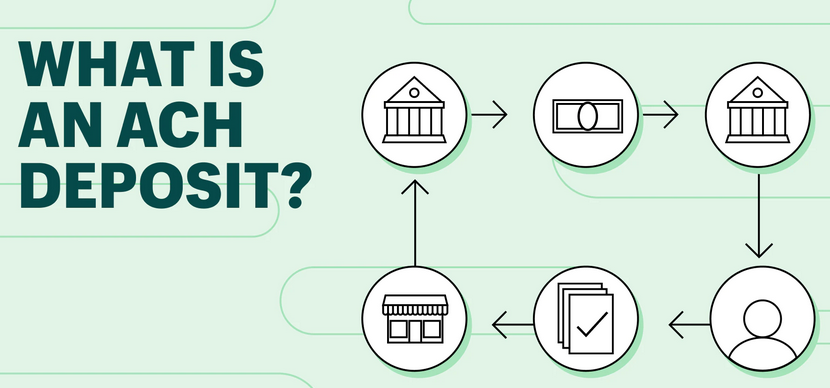

ACH transfers follow a series of steps to facilitate the transfer of funds between bank accounts:

Transaction Initiation

The process begins when a sender initiates an ACH transfer, providing the necessary information, such as the recipient’s bank account number and routing number.

ACH Entry and Batch Processing

The ACH network consolidates multiple transactions into batches and processes them together. This batch processing is one reason why ACH transfers may take longer to complete.

Transaction Posting and Notification

Once the recipient’s bank receives the ACH entry, the funds are posted to their account. Usually, no immediate notification is sent to the recipient, and they may need to check their account to confirm the transfer.

Settlement and Transaction Completion

The ACH network settles the batched transactions, completing the fund transfer between the sender’s and recipient’s banks. The funds become available to the recipient, and the ACH transfer is considered complete.

Types of ACH Money Transfer

ACH transfers encompass two primary types of transactions:

Direct Deposits

Direct deposits are ACH transfers used for crediting funds directly into an individual’s bank account. Common examples include payroll deposits and government benefits.

Direct Payments

Direct payments are ACH transfers used for debiting funds from an individual’s bank account. Examples include utility bill payments and mortgage payments.

ACH Debits vs. ACH Credits

ACH Debits involve funds being pulled from a customer’s account for payment, while ACH Credits involve funds being pushed into a customer’s account, such as direct deposits.

Advantages of ACH Transfers

Let’s explore the benefits of using ACH transfers:

Cost-Effective

ACH transfers are generally more cost-effective than other payment methods, making them ideal for recurring transactions.

Secure

ACH transfers are secure, with robust encryption and authentication protocols to protect sensitive financial information.

Convenient

ACH transfers offer the convenience of automated transactions, reducing the need for manual payment processing.

Disadvantages of ACH Transfers

It’s essential to be aware of potential drawbacks: Longer Transaction Time

ACH transfers may take a few business days to complete, which can be slower than other payment methods, like wire transfers.

Limits on Transfer Amounts

Some financial institutions impose limits on the amount of money that can be transferred using ACH, which may not be suitable for large transactions.

Difficult to Reverse Transfer

Once an ACH transfer is initiated, it can be challenging to reverse the transaction, especially for unauthorized or erroneous transfers.

Conclusion:

Understanding ACH transfers is essential for anyone involved in financial transactions, whether as a business owner or an individual. ACH transfers provide a convenient and cost-effective method for transferring funds, making them a popular choice for various payment needs. While they may take longer to process compared to other payment methods, their secure and automated nature offers numerous advantages. By comprehending the mechanics of ACH transfers, you can make informed decisions when choosing the most suitable payment method for your specific needs.

FAQs about ACH Money Transfer

Let’s address common questions about ACH transfers:

Q1: How many days does an ACH transfer take?

ACH Transfer: ACH transfers typically take 1 to 3 business days to complete.

Q2: Why does an ACH transfer take so long?

The batch processing system used in ACH transfers contributes to the longer processing time compared to real-time payment methods.

Q3: What is the maximum ACH transfer?

The maximum ACH transfer amount varies depending on the financial institution and their policies. Some may impose daily or monthly limits.

Q4: What do you need for an ACH transfer?

To initiate an ACH transfer, you typically need the recipient’s bank account number and routing number.

Q5: Is ACH the same as a wire transfer?

No, ACH transfers and wire transfers are different payment methods. Wire transfers are usually faster but come with higher fees compared to ACH transfers.

Q6: What are the risks of ACH transfer?

The primary risks of ACH transfers are potential delays, limits on transfer amounts, and the difficulty of reversing transactions.