In the world of financial transactions, BIN numbers play a crucial role in ensuring smooth and secure payment processing. If you’ve ever wondered what BIN numbers are and how they work, you’ve come to the right place.

In this comprehensive guide, we will delve into the fundamentals of BIN numbers, their importance, how they function, methods to find them, strategies to protect against fraud, and more. By the end of this article, you’ll have a clear understanding of the significance of BIN numbers in the financial realm.

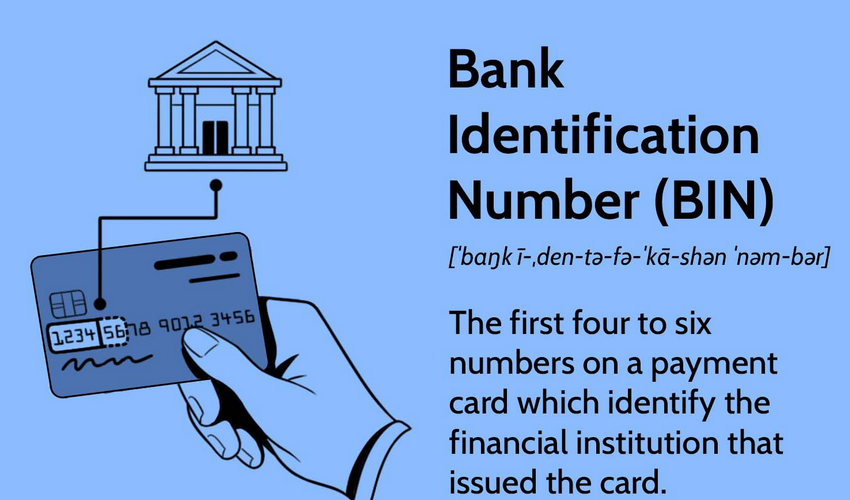

What is a BIN number?

A BIN number, short for Bank Identification Number, is a unique numerical code that identifies financial institutions and is primarily used in the payment card industry. BIN numbers serve as the initial digits of credit, debit, and prepaid card numbers, helping facilitate authentication, routing, and fraud prevention.

Why BINs are important

BIN numbers hold significant importance due to the following reasons:

- Identification: BIN numbers enable quick identification of the card issuer, providing vital information about the issuing bank, card type, and geographic location.

- Routing: BIN numbers assist in routing payment transactions to the appropriate card networks and financial institutions, ensuring seamless processing.

- Fraud Detection: BIN numbers play a critical role in fraud detection and prevention by helping identify suspicious patterns or anomalies associated with specific issuers or regions.

How do BIN numbers work?

Understanding the functionality of BIN numbers is essential to comprehend their role in the payment ecosystem:

- Issuer Identification: The first few digits of a payment card number represent the BIN. These digits correspond to the specific financial institution that issued the card.

- Card Network Identification: BIN numbers also indicate the card network associated with the payment card, such as Visa, Mastercard, American Express, or Discover.

- Metadata: BIN numbers may contain additional metadata, including information about the card type, industry, and region, providing further context for transaction processing.

How to find bank identification numbers (BIN)

Discovering BIN numbers is crucial for various purposes, such as understanding card issuer information or implementing fraud prevention measures.

- BIN Database Providers: Numerous online platforms offer comprehensive BIN databases that provide detailed information about various BIN numbers. These databases are regularly updated and can be accessed for a fee

- Card Network Resources: Card networks like Visa and Mastercard maintain official resources that allow users to lookup BIN information for specific cards or issuers.

How to protect BINs against fraud

Protecting BIN numbers is vital to maintain the security of payment transactions and prevent fraudulent activities. Here are some strategies to safeguard BINs:

- Secure Data Handling: Financial institutions and merchants must adhere to strict data security protocols, including encryption and secure storage, to prevent unauthorized access to BIN information.

- Tokenization: Implementing tokenization techniques can help replace sensitive BIN data with unique tokens, ensuring that the original information is not exposed during transaction processing.

- Fraud Monitoring and Detection: Employing robust fraud monitoring systems can help detect suspicious activities associated with specific BIN numbers, enabling timely intervention and prevention of fraudulent transactions.

Conclusion

BIN numbers are integral to the payment card industry, playing a significant role in identification, routing, and fraud prevention. By understanding how BIN numbers function, where to find them, and the importance of protecting them against fraud, individuals and organizations can enhance their payment security and ensure seamless transaction processing. Getpayment can help you with free consultancy as well as setting up your payment processing account.

FAQs about BIN numbers

Let’s address some frequently asked questions related to BIN numbers:

How do BIN numbers help prevent fraud?

BIN numbers help prevent fraud by identifying the issuer and type of card, allowing merchants to verify the legitimacy of the card before processing a transaction.

Can BIN numbers identify the type of card (debit, credit, prepaid)?

Yes, BIN numbers can identify the type of card (debit, credit, prepaid) based on the specific range of numbers assigned to each card type.

Are BIN numbers the same as the card security code (CVV or CVC)?

No, BIN numbers are not the same as the card security code (CVV or CVC). The card security code is a separate three- or four-digit number printed on the card and serves as an additional security measure.

Can BIN numbers provide information about the issuing country?

Yes, BIN numbers can provide information about the issuing country. The first few digits of the BIN correspond to the issuer’s country or region.What can someone do with your BIN number?

With your BIN number, someone can gather information about the card’s issuer, such as the bank or financial institution, and potentially use this information for unauthorized activities or online fraud.

How many digits is a BIN number?

A BIN number typically consists of six digits, although some may be longer or shorter depending on the card network and issuer.

How do BIN attacks work?

BIN attacks refer to fraudulent activities where attackers use stolen or generated BIN numbers to create counterfeit cards or conduct unauthorized transactions. This can involve exploiting vulnerabilities in payment systems or engaging in card-not-present fraud.